When you retain RNA Advisors, you hire an experienced team of financial and strategic advisors focused, exclusively, on the Life Sciences and Healthcare sectors.

We are not generalists. When you retain RNA Advisors, you hire an experienced team of financial and strategic advisors focused, exclusively (and deliberately), on the Life Sciences and Healthcare sectors.

This narrow focus gives us unique insights into the industry subsectors and the ecosystem enabling both “the science” and innovation to flourish. Our diverse client base provides opportunities for us to cultivate a deep understanding of, and relationships with, industry players so that we can develop data-driven narratives of value that successfully meet the scrutiny of capital market and other stakeholders.

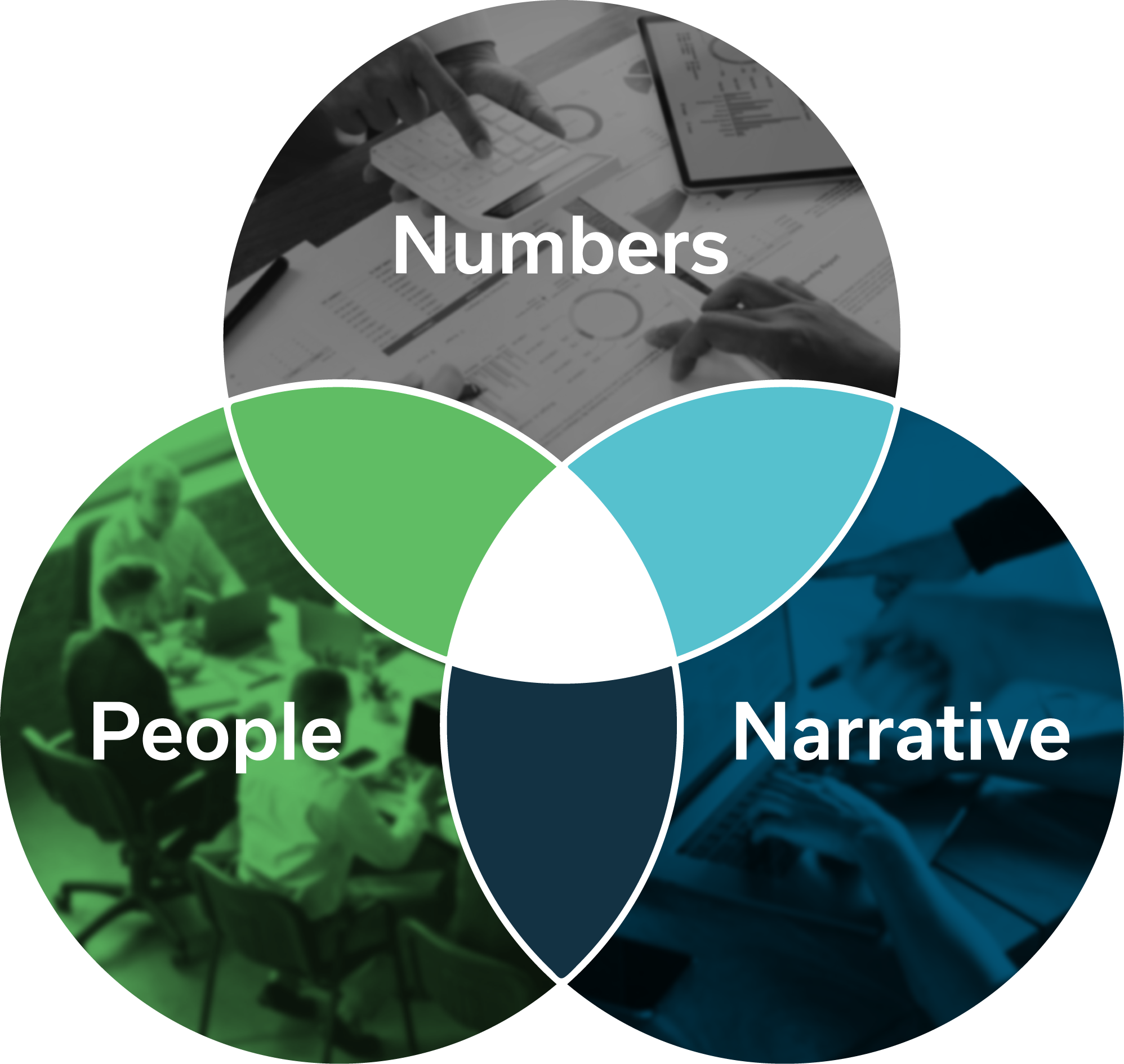

We work collaboratively with our clients to finetune their strategies, tell their valuation stories and improve their decision-making processes based on “the science”, market potential and financial forecasts. We do not believe in purely automated or algorithmic approaches to valuation. We do believe in carefully crafting the investor narratives, numbers and the deal psychology that drive compelling valuation perspectives and successful client outcomes.

Our portfolio of successful client engagements is testament to the RNA team's exceptional depth and breadth of experience:

20+

RNA Advisors

300+

1700+

$21.8B

$282B

Why Hire Us?

We are experts in the Life Sciences and Healthcare sectors.

We therefore have a deep knowledge of the science and systems in these sectors, payor and reimbursement dynamics and model constructs, with support from a wide network of industry relationships. This depth of expertise gives us a unique insider’s perspective.

We know that valuations in Life Sciences and Healthcare are distinctly different.

There are fewer comparable benchmarks, so you must have a deep understanding of different biotech segments, reimbursement schemes, ever-changing market conditions, how markets transact, and how decisions really get made and deals really get done. This is not an area for valuation generalists.

Many clients treat us as an integral part of their business development team. RNA’s suite of client solutions is unlike that offered by other advisors (e.g., valuation firms, accounting firms and investment banks) because we are “full service” and can therefore support our clients for their full “life cycle”. We provide tax/regulatory advisory services, valuation opinions, forecast development and assessment services, business development support services, financial reporting opinions, strategic market assessments, buy side/sell side due diligence services, and fairness opinions (among other services).

At RNA, we know a valuation team must be much more than an analytical powerhouse. The case supporting valuation is best built using a strategic perspective, market savvy and “in the trenches” real-world experience executing transactions. Our ability to bridge the gap between a traditional academic view and actual market conditions is one key to our client’s success.

Our unique blend of strategic and analytic skillsets, and our more wholistic perspective about how to drive more value out of each engagement for our clients, is our “secret sauce” at RNA Advisors.We like to evaluate the likely impacts of going down different paths for different scenarios, and then explore them in a collaborative fashion with our clients. Our clients tell us they value our flexibility, quick response, simple language, clear narratives and down-to-earth approach.

What Our Clients Say

Misti Ushio, Digitalis Ventures

“RNA is always great to work with. They’re smart, they work fast, and they can jump in and get up to speed quickly. When we had critical needs, they’ve been able to really help us out in tough spots.”

Chris Parmentier, Virtue

“We have been working with RNA for several years. They are responsive, reliable, understand the nuances of our business and help us with modeling expertise that exceeds the capabilities within our corporate organization. We value them as an ecosystem partner and as a true extension of our operating team.”

David Chacko, Erasca

“The RNA team is responsive and efficient and understands the nuances of valuation as pertains to our sector, and we valued our partnership with them.”

Chris Vasquez, Biodesix

“The RNA team has been incredibly professional, very responsive to our on-going and sometimes tight turnaround valuation requests and has been an absolute pleasure to work with.”

Chris White, Healthcare Royalty

“We started working with the RNA team when we realized that the large branded firm that we were working with needed too much hand holding to understand our investments and the royalty industry. We switched to RNA because they understand the sector, are responsive and efficient, and are in the flow of the biopharma ecosystem.”

Gary Yeung, YK Bioventures

“RNA Advisors has been my go-to valuation firm for all the companies I have built. In my new capacity as a VC, I would recommend RNA Advisors to all my portfolio companies. RNA staff is one of the industry’s most capable and collaborative experts.”

Alex Mitchell, Dispatch Health

“I inherited the RNA team from the previous CFO and we’ve found them to be fantastic. They get healthcare, valuation, and they get the psychology of value just as much as the tools. They know how to get things done.”

Doug Hughes, Neotrack

“The RNA team is great. Sam and Kayvon have done an exceptional job working with my companies for over a decade. They deliver on time and I don’t have to spend time getting them up to speed because they already know healthcare and medtech.”

Bruce Peacock

“I’ve worked with the RNA team on a number of valuation matters, large and small. These guys know their stuff. Whether using them to assist with large licensing transaction negotiations to simple tax and financial reporting work, they understand and they deliver.”

Matt Zuga, High Cape

“RNA is my go to firm for diligence, modeling and valuation projects. Responsive…check, reliable…check, understand my investments and companies…check.”

Marshall Fordyce, Vera Therapeutics

“The RNA team helped us from inception through our IPO and beyond. They are one of the top firms that I know of at the intersection of valuation, biotech and finance. I’d recommend them for my life science venture-backed company colleagues.”

Robin LaChapelle, Arrivent

“The RNA team has helped us with tax and financial reporting-oriented valuation work. Its nice to work with a firm that not only understands the intricacies of reporting requirements but actually understands the drug development business.”

Stig Hansen, Kimia Therapeutics

“I’ve worked with the RNA team for over a decade across my current and previous companies. They are our go to valuation firm for valuation because they know the industry, are responsive and understand the nuances that drive transactions just as much as accounting.”

Kevin Slawin, Rapha Capital PE

“As the founder of Rapha Capital, an investment advisory, as well as the founder and/or board member of multiple private-stage companies in the biotech and medtech arenas, I’ve worked with RNA in many capacities, including target identification, diligence and in transaction advisory capacities. They are my “go to” firm to help me with all of these needs.”

Jake Frank, SmithRx

“I love the RNA team. They get healthcare and we’ve worked with the team both in valuation advisory capacities as well as on strategic projects for us as we take SmithRx to the next level. These guys get it!”

Roger Moody, Biocartis

“RNA knows the diagnostics space. From Nanosphere to Biocartis, RNA has been my valuation firm of choice. They are responsive, efficient and I know that they’ll deliver. I’ve been glad to see their success and growth. It’s well deserved.”